6.2. 3DS Overview

SBC 3DS Flow

Reference:

EMV® 3-D Secure Protocol and Core Functions Specification

Despite low level message exchange differences in the essence protocol version 2.X differs from 1.0 by introducing and option for the issuer of the card to perform an automatic risk assessment based on the additional contextual data sent from the payer browser or mobile app, whereas 1.0 version always requires payer to pass an authentication challenge. Correspondingly (and according to EMVCo spec) protocol version 2.X includes Frictionless flow (gathering contextual data and performing risk assessment) and Challenge flow (passing authentication challenge). The normal Payer’s web flow which passes 3DS 2.X Authentication can be illustrated as below.

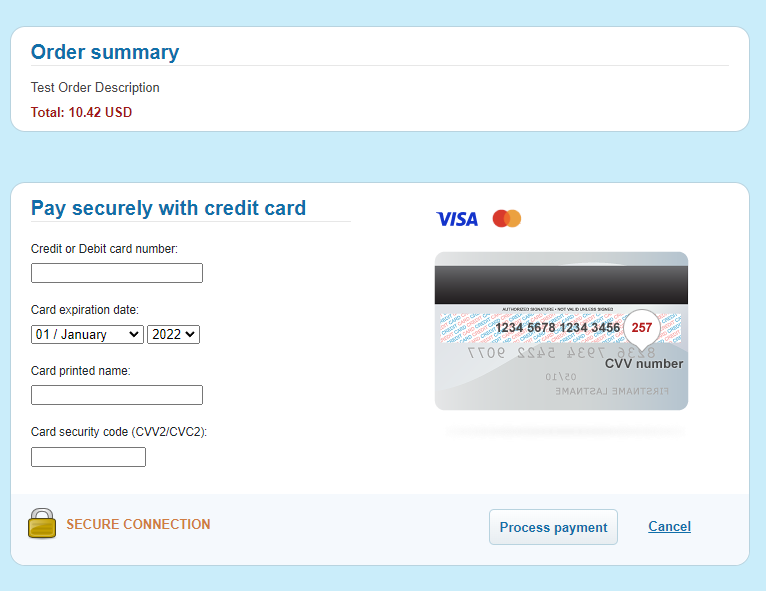

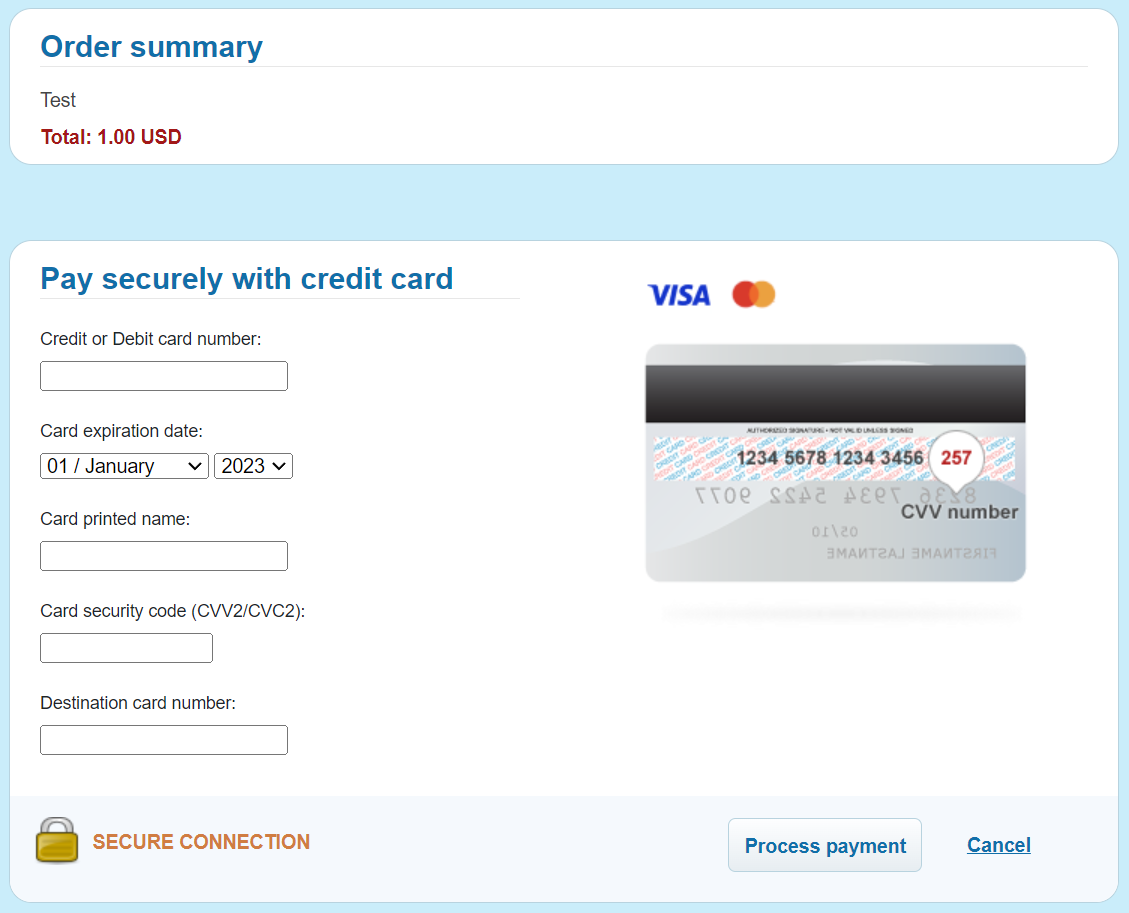

Payers fill out a payment form provided by Connection Party or Payment Gateway side and sends data.

Note

For Transfer transactions, payment form might look as described below.

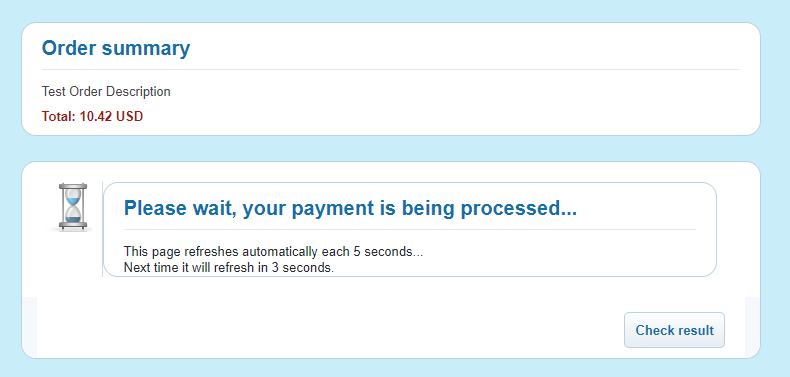

Contextual data is gathered and sent to the Issuer in a hidden process within the browser (Frictionless flow).

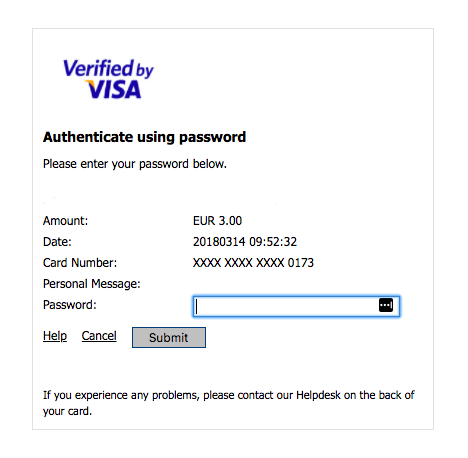

If Issuer finds the transaction risky Payer’s browser gets redirected to the Issuer web page to pass authentication challenge (Challenge flow).

When Payer passes checks the payment authorization is made saving the details related to the 3DS Authentication on the acquirer side.

Payer’s browser gets redirected to the Connecting Party website to the resultant page.

Due to the fact that both protocol versions still used the Connecting party have to deal with both of them as well as specific integrations when acquirer handles 3D Secure communication on its end. For this purpose, Payment Gateway provides universal/generic approach based on the API commands which allow the Connecting party to handle all mentioned cases. The Connecting Party has to start with the 3DS Decision Making Schema of the relevant Use-Case which in turn refers to the more detailed diagram describing specifics of the data handling and Payer’s browser redirects related to the corresponding 3DS flow.

3DS Implementation Scenarios

Implementation Scenario |

Instructions |

|---|---|

3DS is not initiated (non3D). |

3DS Authentication is not initiated. Follow 3DS Decision Making Schema of relevant Use-Case and implement Non3D Flow. |

3DS is initiated and performed by Connecting Party (for PSPs and Acquirers). |

3DS Authentication is initiated and performed by Connecting Party, results are uploaded to Payment Gateway in initial request. Follow 3DS Decision Making Schema of relevant Use-Case and implement Non3D Flow (3DS is performed before the initial request to Payment Gateway). |

3DS is initiated by Payment Gateway and performed on Connecting Party side. |

3DS Authentication is initiated by Payment Gateway. For 3DS 1.0.2, Payer Authentication is performed on Connecting Party side, results are uploaded to Payment Gateway. For 3DS 2.x, 3DS Method and Challenge are performed on Connecting Party side, results are uploaded to Payment Gateway. Additional fields for 3DS Method can be provided by Connecting Party in initial request to speed up the process for 3DS 2.x (tds_status=MethodUrlFrame will be skipped if 3DS Method is not supported by ACS). Follow 3DS Decision Making Schema of relevant Use-Case and implement all 3DS Flows. |

3DS is initiated and performed by Payment Gateway. |

3DS Authentication is initiated by Payment Gateway, all 3DS scenarios are performed on Payment Gateway side. Follow 3DS Decision Making Schema of relevant Use-Case, implement Simplified Authentication Flow (ignore tds_status parameter presence, use html or redirect-to parameters to redirect the Payer to Payment Gateway) and Non3D Flow (if Payer’s card is not enrolled or processing is Non3D). |

3DS Decision Making Schema

Connecting party has to implement all steps marked in green and purple. Below are the description for steps which reference specific API commands according to the step ID:

Non3D Flow

Transaction should be considered as non3D (no 3DS authentication) if all conditions are met:

Note

Please note that transaction status “unknown” might appear for both 3DS and non3D transactions. See details in Statuses.

3DS 2.x.0 Frictionless Flow

Connecting party has to implement all steps marked in green. Below are the description for steps which reference specific API commands according to the step ID:

3DS Method HTML Page Example

3DS Method HTML Page example below performs 3DS Method initiation through iframe technique and holding of the Payer’s browser until the 3DS Method is not finished on the Connecting Party server. Once it is finished or timeout is reached Connecting Party has to follow the next steps following 3DS Decision Making Schema and redirect Payer’s browser to the corresponding URL (either Challenge Flow or payment result page). Normal timeout value is 30 sec.

3DS Method HTML Page consists of the following parameters:

Parameter |

Description |

|---|---|

tds-method-url-frame-3ds-method-url |

ACS 3DS Method URL is received by the Connecting Party in the /api/v2/status/ response. |

tdsMethodUploadUrl |

Connecting Party’s URL, where the result comes after the completion of the flow. |

threeDSMethodData |

JSON value containing threeDSServerTransID and threeDSMethodNotificationURL. See below how to construct threeDSMethodData. |

Construct threeDSMethodData

In order to construct threeDSMethodData the Connecting Party has to use the following parameters.

Parameter |

Description |

|---|---|

threeDSServerTransID |

Universally unique transaction identifier assigned by the 3DS Server to identify a single transaction.

Received in the /api/v2/status/ response as tds-method-url-frame-3ds-server-trans-id parameter.

|

threeDSMethodNotificationURL |

The URL that will receive the notification of 3DS Method completion from the ACS. The Connecting Party is responsible for providing valid threeDSMethodNotificationURL. Normally when the Connecting Party receives any request on this URL is has to return 3DS Method Done HTML Page (see example below). |

threeDSMethodData construction example

Construct threeDSMethodData JSON.

{"threeDSServerTransID":"3d671629-a410-4a5d-9288-b38ceadd41f2","threeDSMethodNotificationURL":"https://connectingparty.com/3ds-method-complete/"}

Apply base64 url encoding to resultant JSON.

eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6IjNkNjcxNjI5LWE0MTAtNGE1ZC05Mjg4LWIzOGNlYWRkNDFmMiIsInRocmVlRFNNZXRob2ROb3RpZmljYXRpb25VUkwiOiJodHRwczovL21lcmNoYW50LmNvbS8zZHMtbWV0aG9kLWNvbXBsZXRlLyJ9

Generate Fingerprint

The 3DS Method can be optionally used by issuers to gather browser fingerprints using JavaScript. This is done by loading a URL in a hidden iframe, before the authentication. This iframe will then execute some fingerprinting JavaScript, before POST’ing to the prespecified URL belonging to the requestor. The 3DS Method fingerprint result is tied to the authentication by the threeDSServerTransID.

function gatherBrowserData() {

var colorDepth = screen.colorDepth; // 24

var javaEnabled = navigator.javaEnabled(); // true

var browserLanguage = navigator.language; // en_US

var screenHeight = screen.height; // 1080

var screenWidth = screen.width; // 1920

var userAgent = navigator.userAgent; // Mozilla/5.0 (Windows NT 6.1; Win64; x64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/70.0.3538.110 Safari/537.36

var browserTimezoneZoneOffset = new Date().getTimezoneOffset(); // 0

}

Construct 3DS Method HTML page example:

<!DOCTYPE html>

<html lang="en">

<head>

<meta charset="utf-8"/>

<title>ACS v2 3DS Method ...</title>

<style>

.progress{

position: absolute;

height: 10px;

width: 100%;

}

.progress .color{

position: absolute;

background-color: #444;

width: 100%;

height: 10px;

animation: progres 11s linear;

}

@keyframes progres{

0%{

width: 0%;

background-color: #ddd;

}

25%{

width: 50%;

background-color: #ccc;

}

50%{

width: 75%;

background-color: #bbb;

}

75%{

width: 85%;

background-color: #aaa;

}

100%{

width: 100%;

background-color: #777;

}

};

</style>

<script>

var fallbackTimeout = null;

function processForm() {

document.title = "ACS v2 AReq ...";

document.getElementById( "browserJavaEnabled" ).value = navigator.javaEnabled();

document.getElementById( "browserJavascriptEnabled" ).value = true;

document.getElementById( "browserLanguage" ).value = navigator.language;

document.getElementById( "browserColorDepth" ).value = screen.colorDepth;

document.getElementById( "browserScreenHeight" ).value = screen.height;

document.getElementById( "browserScreenWidth" ).value = screen.width;

document.getElementById( "browserTZ" ).value = new Date().getTimezoneOffset();

document.autoForm.submit();

}

function onPostMessage(event) {

if(!event.data.hasOwnProperty('methodNotification')) {

return;

}

if(fallbackTimeout != null) {

clearTimeout(fallbackTimeout);

fallbackTimeout = null;

}

document.getElementById( "threeDSCompInd" ).value = 'Y';

processForm();

}

function onPageLoaded() {

fallbackTimeout = setTimeout(processForm, 10 * 1000);

document.methodForm.submit();

window.addEventListener('message', onPostMessage);

}

</script>

</head>

<body onload="onPageLoaded()">

<div class="progress">

<div class="color"></div>

</div>

<iframe style="width:0; height:0; border:0;" name="methodFrame"></iframe>

<form name="methodForm" target="methodFrame" action="[=tds-method-url-frame-3ds-method-url]" method="POST">

<input type="hidden" name="threeDSMethodData" value="[=threeDSMethodData]">

</form>

<form name="autoForm" action="[=tdsMethodUploadUrl]" method="post">

<input type="hidden" name="threeDSServerTransID" value="[=threeDSServerTransID]"/>

<input type="hidden" name="threeDSCompInd" id="threeDSCompInd" value="N"/>

<input type="hidden" name="browserJavaEnabled" id="browserJavaEnabled" value="" />

<input type="hidden" name="browserJavascriptEnabled" id="browserJavascriptEnabled" value="" />

<input type="hidden" name="browserLanguage" id="browserLanguage" value="" />

<input type="hidden" name="browserColorDepth" id="browserColorDepth" value="" />

<input type="hidden" name="browserScreenHeight" id="browserScreenHeight" value="" />

<input type="hidden" name="browserScreenWidth" id="browserScreenWidth" value="" />

<input type="hidden" name="browserTZ" id="browserTZ" value="" />

<noscript>

<input type="submit" name="submit" value="Upload 3DS Method Result"/>

</noscript>

</form>

</body>

</html>

Process 3DS Method Notification

When 3DS Method is completed, the Connecting Party receives HTTP POST request at threeDSMethodNotificationURL with threeDSMethodData, which contains threeDSServerTransID (in base64 encoded JSON).

Get threeDSMethodData.

threeDSMethodData=eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6IjNkNjcxNjI5LWE0MTAtNGE1ZC05Mjg4LWIzOGNlYWRkNDFmMiJ9Cg

Apply base64 url decoding to get JSON, which contains threeDSServerTransID.

{"threeDSServerTransID":"3d671629-a410-4a5d-9288-b38ceadd41f2"}

3DS Method Done HTML Page Example

<!DOCTYPE html>

<html lang="en">

<head>

<meta charset="utf-8"/>

<title>ACS v2 3DS Method Notification Handler...</title>

<script>

window.parent.postMessage({ methodNotification: "COMPLETE" }, "*");

</script>

</head>

<body>

<p>This should not be displayed</p>

</body>

</html>

3DS 2.x.0 Challenge Flow

CReq HTML Page Example

CReq HTML Page redirects the Payer’s browser to ACS Server URL, provided in tds-creq-form-acs-url parameter. The result CRes value will be returned from ACS to notificationURL provided by Connecting Party in /api/3ds/v1/upload-method-url-result request during 3DS 2.x.0 Frictionless Flow.

Field |

Description |

Necessity |

|---|---|---|

creq |

ACS 3DS CReq data, which received by the Connecting Party in the /api/v2/status/ response. The same as tds-creq-form-creq. |

Required |

threeDSSessionData |

value which will be posted back within CRes to notificationURL at the end of the process. Max length: 1024 bytes, format: Alphanumeric, Base64url encoded without padding. |

Optional |

<!DOCTYPE html>

<html>

<head>

<meta http-equiv="content-type" content="text/html; charset=UTF-8">

<title>Redirecting ...</title>

<script type="text/javascript" language="javascript">

function makeSubmit() {

document.returnform.submit();

}

</script>

</head>

<body onLoad="makeSubmit()">

<form name="returnform" action="https://acs.bank-domain.com/mdpayacs/creq" method="POST">

<input type="hidden" name="creq" value="eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6ImM1NDA5N2VhLTc0ZTctNDE2My05MTQ4LTNjMTY1NTg3NGIwMCIsImFjc1RyYW5zSUQiOiIxMjU1NTkyMi1lZmYzLTRjOTQtOTk4Mi0yMDM3NjJhMzdmMjkiLCJjaGFsbGVuZ2VXaW5kb3dTaXplIjoiMDIiLCJtZXNzYWdlVHlwZSI6IkNSZXEiLCJtZXNzYWdlVmVyc2lvbiI6IjIuMS4wIn0=">

<input type="hidden" name="threeDSSessionData" value="NjY4MDU3NQ">

<noscript>

<input type="submit" name="submit" value="Press this button to continue"/>

</noscript>

</form>

</body>

</html>

3DS 1.0.2 Authentication Flow

PaReq HTML Page Example

PaReq HTML Page redirects the Payer’s browser to ACS Server URL, provided in tds-pareq-form-acs-url parameter.

PaReq HTML Page consists of the following parameters:

Field |

Description |

Necessity |

|---|---|---|

tds-pareq-form-acs-url |

ACS 3DS PaReq URL is received by the Connecting Party in the /api/v2/status/ response. |

Required |

MD |

Connecting Party Data, which comes back to your termination page. |

Optional |

PaReq |

ACS 3DS PaReq data, which received by the Connecting Party in the /api/v2/status/ response. The same as tds-pareq-form-pareq. |

Required |

TermURL |

URL of termination page, where the Payer gets redirected back with PaRes data submitted. |

Required |

<!DOCTYPE html>

<html>

<head>

<meta http-equiv="content-type" content="text/html; charset=UTF-8">

<title>Loading acs..</title>

<script type="text/javascript" language="javascript">

function makeSubmit() {

document.returnform.submit();

}

</script>

</head>

<body onLoad="makeSubmit()">

<form name="returnform" action="$tds-pareq-form-acs-url" method="POST">

<input type="hidden" name="MD" value="some_merchant_data"/>

<input type="hidden" name="PaReq" value="$tds-pareq-form-pareq"/>

<input type="hidden" name="TermUrl" value="https://termination.page"/>

<noscript>

<input type="submit" name="submit" value="Submit"/>

</noscript>

</form>

</body>

</html>

Simplified Authentication Flow

Alternative cardholder authentication

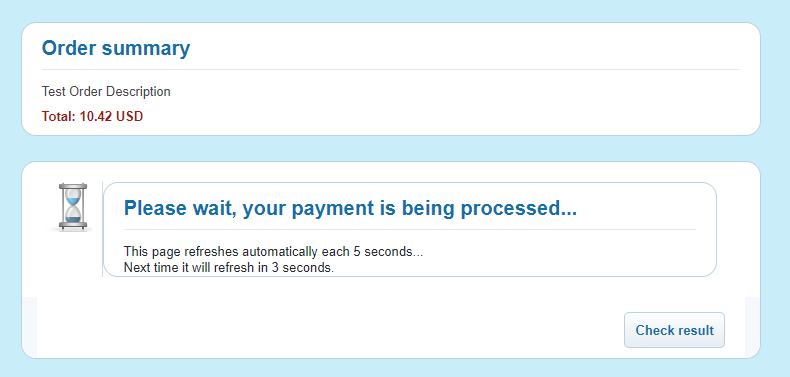

Payment Gateway supports alternative methods for cardholder authentication if card is not enrolled to 3DS (negative 3DS enrollment response). One of such methods is random sum check. In this method, Payment Gateway initiates an additional preauthorization transaction to hold a random small amount on cardholder’s account and sends a special form for the Payer to enter the amount being held. If the amount is correct, Payment Gateway continues to process the initial transaction. The small amount hold is cancelled automatically.

General diagram for form transactions

General diagram for direct integrations